Landfill Tax Changes in April 2025: What Businesses Need to Know

Following the 2024 Spring Budget announcement, the cost of the landfill tax is set to rise from April 2025. This upcoming tax increase and implementation of the Simpler Recycling legislation in 2025 will encourage businesses to reduce sending unnecessary waste to landfill and adopt better waste management practices to prioritise recycling.

The amount of Biodegradable Municipal Waste sent to landfill rose to 6.8 million tonnes in 2021 from 6.1 million tonnes in 2020 (source: UK statistics on waste). This includes food waste, green waste, cardboard and paper that could otherwise be recycled, highlighting the importance of initiatives promoting responsible waste disposal and management that are environmentally sustainable.

The Landfill tax changes are as follows:

| Material sent to landfill | From 1 April 2024 | From 1 April 2025 |

| Coverage | England and Northern Ireland | England and Northern Ireland |

| Standard rate (per tonne) | £103.70 | £126.15 |

| Lower rate (per tonne) | £3.30 | £4.05 |

Read on to learn more about the landfill tax increase and what it means for your business…

What is Landfill Tax

Landfill Tax is an environmental charge determined by weight (per tonne) applied to the disposal of waste in landfills. This charge is levied on the operator responsible for the management of the landfill site, who will then charge back to their business customers through normal billing processes.

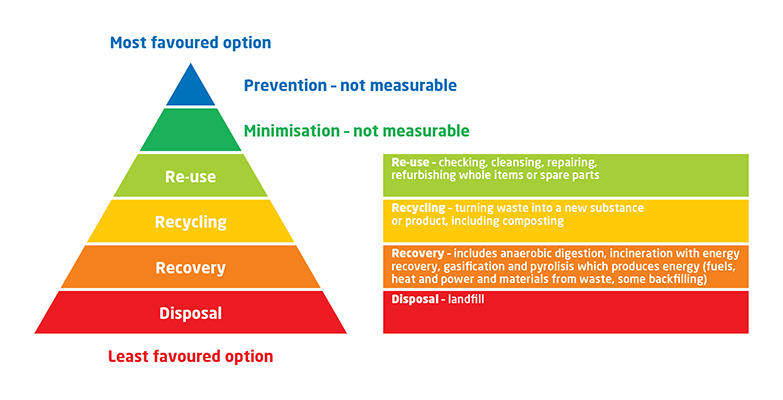

This tax encourages businesses to consider alternative waste disposal methods by avoiding placing recyclable waste (e.g. food waste or other Dry Mixed Recyclables) into general waste (black bag) bins. By adopting the "5 Rs'' principles : Refuse, Reduce, Reuse, Repurpose, and Recycle (waste hierarchy) businesses will improve their recycling and reduce the amount sent to landfill.

How are the landfill tax rates applied?

The landfill tax is split into 2 rates of Standard and Lower which determine how much per tonne is charged. These are:- Lower rate: Non-hazardous, materials which are not biodegradable and with low polluting potential such as naturally occurring rocks and soil, rubble from demolition and glass. A full list of materials that qualify for the lower rate can be found in the Government's Guide to Landfill Tax

- Standard rate: The standard landfill tax rate applies to all other taxable materials, such as general commercial waste, non-inert waste, and mixed waste. This also includes all disposals at unauthorised sites.

Many items currently sent to landfill could be recycled. Together with the introduction of the Simpler Recycling legislation, these measures aim to reduce landfill use and promote more sustainable waste management - saving your business money in the process.

What is the impact to businesses?

As a result businesses now have a stronger financial incentive to change how they dispose of their waste. Waste operators will have no option but to increase prices for customers who send general waste to landfill – for some businesses, they could see a significant rise in costs because of the weight and type of waste disposed of.

Food waste is a contributor to landfill - with 1.1m tonnes produced annually by the Hospitality & Food services (lordslibrary.parliament.uk/food-waste-in-the-uk). The tax change could mean large price increases for those businesses which do not recycle their food waste.

Simpler Recycling

Simpler Recycling is a new government legislation to be introduced on 31 March 2025 aiming to increase recycling rates by standardising recycling practices across the UK. Businesses will be required to dispose of all food waste into specific food waste bins so that it can be collected for recycling, prohibiting the disposal of food in general waste bins or with other recyclables.

Businesses are advised to dispose of dry-mixed recycling items like recyclable paper, cardboard, metals, and plastics together in a single bin for effective disposal and collection, while placing non-recyclables in general waste.

When these two measures work together, they will help create more sustainable waste management practices and a stronger culture of recycling. The Simpler Recycling Legislation will help ensure that businesses know how to correctly recycle, while the landfill tax increase financially incentivises recycling efforts - leading to higher recycling rates and reduced waste to landfill.

Learn more about the impact of the new Simpler Recycling Legislation and how to prepare your business for the March 2025 launch, visit our Simpler Recycling guide.

What can businesses do to avoid sending waste to landfill?

To reduce costs, businesses can adopt the principles of the “5 Rs”: Refuse, Reduce, Reuse, Repurpose, and Recycle and follow the principles of the Waste Hierarchy - which gives priority of waste prevention, followed by preparing for reuse, recycling, recovery and finally disposal.

Recycling plays a crucial role by diverting waste away from landfill through processing materials into useful resources. By having the correct recycling containers and waste management processes in place, you can divert waste from landfills, support a more sustainable future, and save your business money.

Instead of ending in landfill, Hills Waste Solutions process your recyclable materials the responsible way:

- Food waste: Hills Waste Solutions collect your food waste and transport it to a local facility for recycling through innovative anaerobic digestion technology. This process generates energy for the National Grid and fertiliser for farming.

- Dry mixed recycling: All Dry mixed recycling is collected together and taken to a material recovery facility, where it is sorted by material for re-processing, ready to be turned into a new product.

- Glass waste: Glass is 100% recyclable! We collect your glass waste and arrange for it to be recycled. This process involves melting it down to turn into new packaging products or re-used in aggregates

It's important to partner with a reliable waste carrier to manage your business waste responsibly - and with 213,149 tonnes of waste diverted from landfill by Hill Waste Solutions in Fiscal Year 2023, you can have peace of mind that we have the expertise required to help support your sustainability goals.

Contact our expert team to learn how we can effectively manage your waste and help save your business extra landfill tax costs.